An emerging market with a highly active and varied player base, the Netherlands has quickly become a significant opportunity for operators across the iGaming world. With the legalization of online gambling coming into effect in 2021, the growth seen in player engagement and brand diversity has set in motion a perpetual uptake in recent years for this new thriving market within the EU.

Contents:

- The Current Netherlands iGaming Market

- Preferences of Dutch Online Gamblers

- Casino in the Dutch market

- Sports Betting in the Dutch market

- Preferred Payment Methods in the Dutch Market

- Online Gambling Legislation in the Netherlands

- Advertising Rules for Gambling in the Netherlands

- The Future of Gambling in the Netherlands

The Current Netherlands iGaming Market

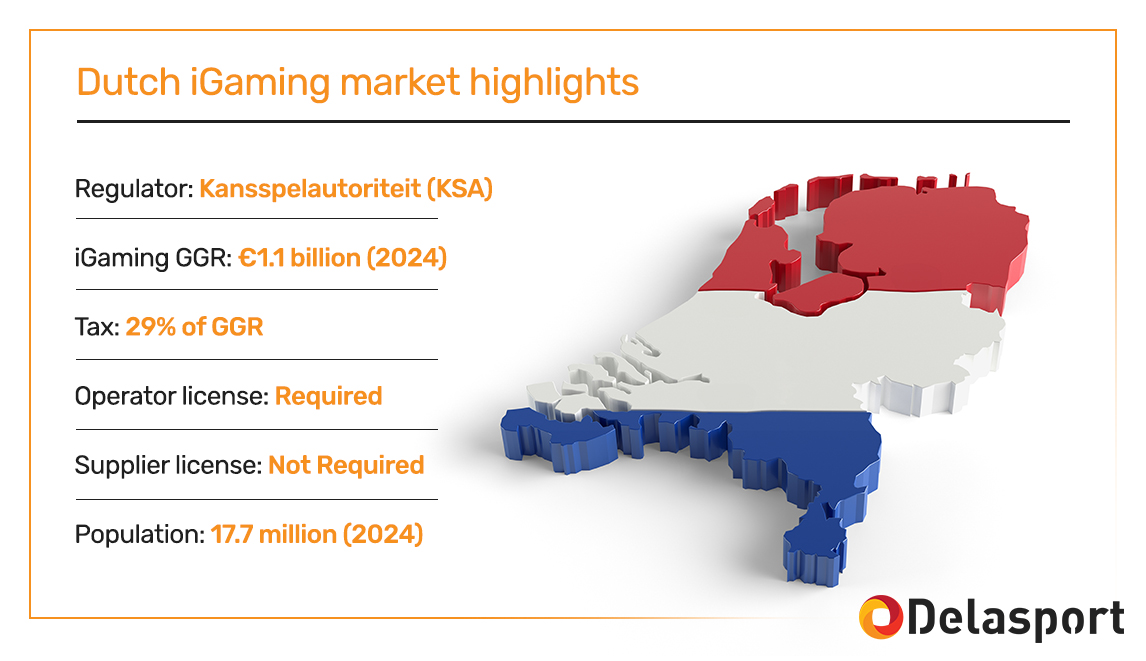

With the legalization of online gambling, under the Remote Gambling Act (Wet Kansspelen op afstand, KOA) which came into force in April 2021 the Dutch market was well underway to capitalize on an already educated and motivated player population. The ever-inflating number of active online gambling participation has set great standards for the coming years with a player base forecasted to grow over 1.5 million by the end of 2024.

Revenue-wise, the Netherlands is also doing incredibly well: the projected revenue for this year (2024) is over €1.1 billion (Source). And with a stable annual growth rate of above 5.4%, forecasts point to a result of €1.44 billion by 2029.

Preferences of Dutch Online Gamblers

In the Netherlands, casino games lead, but sports betting gains ground among youth.

Recent data from the Netherlands Gambling Authority (KSA) sheds light on the evolving landscape of online gambling in the country. Casino games continue to dominate the digital betting sphere, commanding a substantial 73% of the gross gaming revenue. This figure underscores the enduring appeal of traditional casino offerings in the digital age.

However, sports betting is carving out a significant niche, accounting for approximately 25% of the market. This sizable portion suggests a robust appetite for sports wagering among Dutch punters, despite the overwhelming popularity of casino games.

Perhaps most intriguing is the emerging trend among younger adults. A recent study, by Loket Kansspelm reveals that six out of ten Dutch young adults anticipate placing sports bets this summer. This statistic points to a growing gambling interest within the younger demographic, potentially signaling a shift in future market dynamics.

The data presents a nuanced picture of the Dutch online gambling scene. While casino games maintain their stronghold, the notable presence of sports betting and its particular appeal to younger adults indicate a market in flux. As the industry continues to evolve, these trends may reshape the betting landscape in the Netherlands, with potential implications for operators, regulators, and society at large.

Mobile gaming has been the preferred variant for the country’s players, in part due to the high engagement of a younger player base and, of course, the ever-developing shift to mobile friendly platforms within almost all major online content.

With a bustling and mid to high-income youthful demographic to service, current and future operators of the industry can capitalize promptly should they meet the high-standard for technology and new-age iGaming inclinations of the market.

Casino in the Dutch Market

As mentioned, Casino games and slots in particular are very popular among Dutch casino fans. They are simple to understand and come in many versions with different themes and features.

Dutch players enjoy classic casino table games like blackjack, roulette, baccarat, and craps. Online casinos offer dozens of variants of these games from various providers to cater to player preferences.

Live dealer games are another popular choice, allowing players to interact with human dealers and each other for a more immersive experience.

Some of the top games in the market include:

- Simply Wild by Stakelogic – This classic slot accounts for 54% of all Google searches for slots in the Netherlands, indicating its immense popularity among Dutch players.

- Random Runner by StakeLogic – This is the second most popular slot in the Netherlands, reaching a position it does not achieve in any other country.

- Mega Joker by NetEnt – This retro-style slot with fruit symbols has an impressive 99% RTP, making it one of the best payout slots for Dutch players.

Sports Betting in the Dutch Market

Dutch bettors have a strong preference for soccer betting, with the Eredivisie (Dutch top division) and international leagues like the Premier League, La Liga, and Serie A being particularly popular. Soccer dominates the sports betting market in the Netherlands due to the country’s deep-rooted football culture and the wide variety of domestic and international matches available. Beyond soccer, Dutch bettors also enjoy wagering on other sports such as Formula One racing, hockey, volleyball, cycling, tennis, golf, and UFC. The Netherlands’ thriving sports culture provides bettors with ample options to indulge in their favorite pastimes.

Preferred Payment Methods in the Dutch Market

In the competitive landscape of online gambling, Dutch players are not just looking for compelling games – they’re seeking seamless financial transactions. The savvy Dutch gambler comes to the virtual casino floor with well-established preferences for managing their funds, making a diverse array of payment options a critical factor in their choice of platform.

This financial sophistication spans a broad spectrum of methods. On one end, we see the enduring popularity of traditional options: credit and debit cards continue to hold their ground, while wire transfers and prepaid cards remain trusted standbys for many players. These conventional choices offer a sense of familiarity and security that resonates with a significant portion of the Dutch gambling community.

However, the modern Dutch player is equally at home with cutting-edge financial technology. E-wallets have surged in popularity, offering speed and convenience that align perfectly with the fast-paced nature of online gaming. Cryptocurrencies, once a fringe option, are increasingly entering the mainstream, appealing to those who value privacy and decentralization. Mobile payment apps, seamlessly integrated into players’ everyday lives, are making their mark in the casino and Sportsbook world as well.

The message to online casinos is clear: versatility is vital. To capture and retain the attention of Dutch players, gaming platforms must offer a rich tapestry of banking options. This isn’t just about providing choices – it’s about creating an ecosystem where players can move their funds with the same ease and flexibility they enjoy in other aspects of their digital lives.

In essence, for online Sportsbook and casinos eyeing the Dutch market, the ability to accommodate diverse financial preferences isn’t just a feature – it’s a fundamental requirement. By offering a comprehensive suite of deposit and withdrawal methods, casinos can position themselves as responsive, player-centric platforms in this discerning and evolving market.

Online Gambling Legislation in the Netherlands

Legislation and regulation in the market is enforced by the Netherlands Gambling Authority (Kansspelautoriteit or KSA), which was established to handle the more recent legalization of online gambling by the KOA Act (also known as The Remote Gambling Act), predating it little less than a decade with its founding in early 2012.

As with any well–regulated and booming market within the industry, operators looking to receive licensing are subject to scrutinous and consistent standards of product to be eligible.

These conditions are set to meet an operator base that is well-suited to providing a transparent service to the Dutch player, with uncompromising criteria in player protection, fraud, money laundering prevention, and responsible gaming as a foundation.

Notably, licensed operators are subject to a 29% tax on their gross revenue and must contribute in part to the Gambling Addiction Prevention Fund.

Advertising Rules for Gambling in the Netherlands

Advertising within the Netherlands, as with most EU nations when it comes to age-restricted content, has rather unmalleable guidelines.

The KSA (Kansspelautoriteit) helps ensure that content produced by iGaming brands meets the familiar standards of service transparency, target audience viability, and inclusion of gambling addiction risk disclosure. Parallel to these standard practices in gambling advertisement, it also imposes an acute rule set for advertisements in regard to runtime, show times, and even the use of celebrity or role model figures within the content.

The online gambling ad space in the Dutch market is now recognized as a leader in responsible gaming and consumer protection within the EU and even beyond.

The Future of Gambling in the Netherlands

The Netherlands has emerged as a tantalizing prospect in the European online gambling landscape. With its substantial population, widespread internet access, and a growing enthusiasm for digital wagering, the country presents a golden opportunity for licensed operators. This burgeoning market has not gone unnoticed, with the regulatory authority already granting 25 licenses, signaling a robust and competitive ecosystem.

A newly regulated, high-value, and expressly player–protection–centric market like the one thriving in the Netherlands is an exciting step into the future of iGaming.

With an ever-growing player population, trending platform advancements in personalization, customization, contemporary betting mechanics, and engaging original content, the Netherlands provides ground for any brand to thrive once they grasp the significance of this new-era market.

However, this digital gold rush is not without its complexities. Operators venturing into the Dutch market must navigate a labyrinth of stringent compliance requirements. Consumer protection stands at the forefront of regulatory concerns, with authorities implementing rigorous measures to safeguard players. Anti-money laundering (AML) protocols demand meticulous attention, while advertising regulations require a delicate balance between promotion and responsibility.

The Dutch online gambling sector continues to exhibit strong growth potential. However, the road ahead may not be without its bumps. Industry analysts anticipate a possible near-term slowdown as the market adjusts to evolving regulations and competitive pressures.

For operators eyeing success in this lucrative yet complex arena, adaptability will be key. The ability to pivot strategies in response to regulatory changes, while maintaining strict compliance, will separate the winners from the also-rans. As the Dutch online gambling landscape continues to evolve, those who can successfully balance opportunity with responsibility stand to reap significant rewards in this dynamic market.

And if you’re an ambitious operator looking to enter or expand in the Netherlands, you’ve just found a reliable partner: Delasport is not only a leading supplier globally, but has experience in the Dutch market, as evident from our latest deal with OneCasino.

So, make sure you get in touch as soon as possible to grant your business a real shot at success in the region.